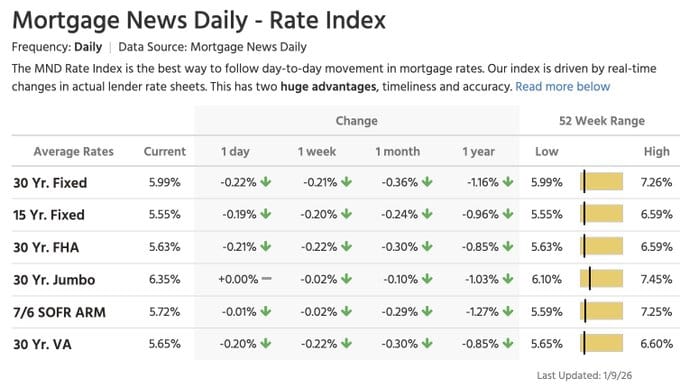

This morning brought news that caught everyone's attention: the average 30-year fixed mortgage rate dropped to 5.99%—the lowest we've seen since February 2023. This comes just one day after Trump's announcement that Fannie Mae and Freddie Mac will buy $200 billion in mortgage backed securities (MBS).

Coincidence? Not quite. Here's what's happening and what it means for Utah buyers and sellers.

Table of Contents

The Breaking News: Rates at 5.99%

Big one-day mortgage rate drop:

Today's rate: 5.99%

Same day last year: 7.15%

10-year Treasury yield: 4.17%

Mortgage spread: 182 basis points (getting close to the historic average of 176 bps)

The bond market reacted immediately to Trump's MBS purchase announcement, and we're seeing the effect play out in real-time.

Current average mortgage rates.

Average 30-year conventional mortgage rate at lowest rate since Feb. 2023.

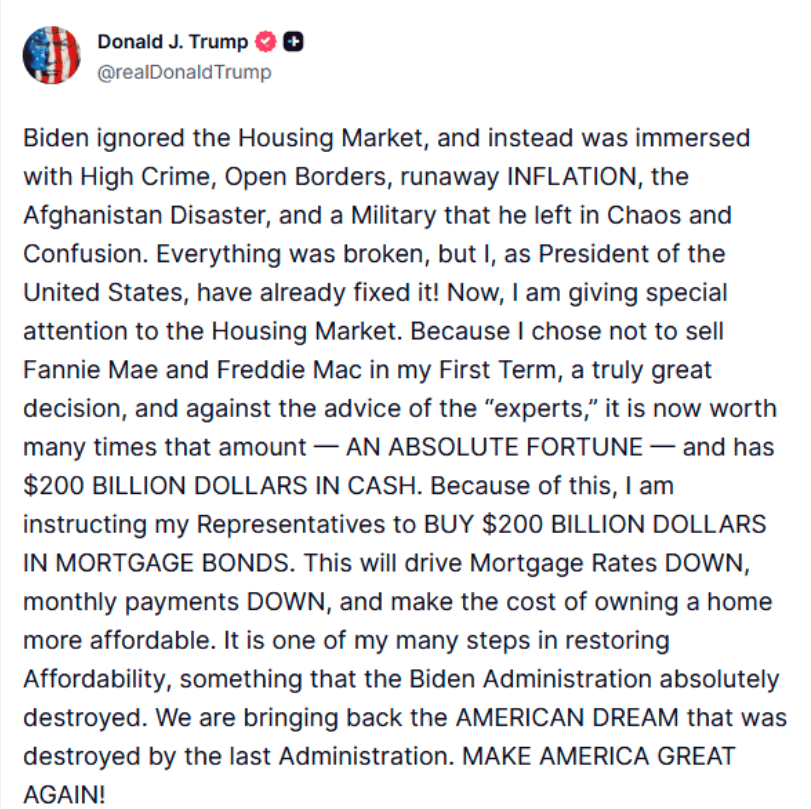

What Trump Just Announced

This week brought two major housing policy announcements from the White House that could reshape the market:

1. Fannie Mae and Freddie Mac will buy $200 billion in mortgage bonds

The goal? Push mortgage rates down by increasing demand for mortgage backed securities (also referred to as mortgage bonds). When bond demand goes up, bond prices rise and yields (mortgage rates) fall—similar to what the Federal Reserve did during the pandemic when they bought trillions in mortgage backed securities.

Trump's full announcement emphasized that keeping Fannie and Freddie in government control (rather than selling them off in his first term) was "a truly great decision" that now allows them to deploy $200 billion in cash to buy mortgage bonds and "drive mortgage rates down, monthly payments down, and make the cost of owning a home more affordable."

2. Banning institutional investors from buying single-family homes

Trump announced he's "immediately taking steps to ban large institutional investors from buying more single-family homes" and will call on Congress to codify it into law. Senator Bernie Moreno committed to introducing legislation in the Senate.

Why the Mortgage Spread Matters

The "mortgage spread" is the difference between the 10-year Treasury yield and the average 30-year mortgage rate. This spread hit 2.96 percentage points back in June 2023—way above the historical average of 1.76 points since 1972.

As of December, that spread had compressed to 2.05 points. Today's announcement pushed it down to 187 basis points, bringing us closer to that historic average.

What's driving this? After the Federal Reserve stopped buying mortgage-backed securities in 2022, the market lost its largest MBS buyer. That created upward pressure on mortgage rates beyond what Treasury yields alone would suggest. Fannie and Freddie stepping in as buyers helps fill that gap.

Mortgage Rate Reality (Near-Term vs. Long-Term)

Near-term:

The immediate market reaction is real—we're seeing it in today's rates. The $200 billion bond purchase is creating genuine downward pressure on rates right now.

Long-term questions remain:

Fannie and Freddie already added about $70 billion in the second half of 2025

Adding another $200 billion would push them close to their legal limit of $450 billion total

Is this a one-time infusion or sustained buying?

Most economists say that without sustained, predictable purchases like the Fed made during the pandemic (they bought over $2 trillion in MBS), any rate drop will likely be modest compared to what many hope for.

The bigger concern:

Even if rates drop temporarily, increased buyer demand could push home prices up, offsetting some affordability gains—especially for first-time buyers without existing equity.

The Institutional Investor Ban: What It Actually Changes

Here's the surprising part: institutional investors only account for about 1% of all single-family home purchases nationwide right now. At their peak in 2022, they made up 3.1% of transactions—but that dropped to around 1% over the past few years as the math became less attractive with higher rates.

For Utah specifically: While we don't have massive institutional ownership like Phoenix or Atlanta (where some neighborhoods hit 10-20% institutional ownership), this policy would primarily affect Sun Belt markets more than ours. Nationally, large investors own about 1% of total single-family housing stock, but that varies dramatically by region.

What sellers should know: The announcement said "ban from buying more"—not forcing sales of existing holdings. So we're unlikely to see a flood of institutional sell-offs hitting the market. In Utah, where mom-and-pop landlords dominate the rental market, the impact will be minimal.

What buyers should know: Removing 1% of buyer competition won't dramatically change affordability on its own. The real issue remains supply—we need more homes built, not fewer buyers.

The wildcard: If the ban extends to build-to-rent developments (which currently make up about 8% of new single-family construction, up from 3% pre-pandemic), it could actually slow new construction. That could hurt affordability long-term by reducing supply.

What This Means for You

If you're buying:

This rate drop creates a real opportunity window—but don't wait for rates to hit 4% or 5%. Market conditions shift quickly, and as we saw last September when the Fed cut rates, mortgage rates actually went UP after the announcement because the market had already priced it in. The best rates often come just before policy changes, not after.

A drop from 7% to 6% on a $500,000 home saves you about $300/month. That's real money that improves your buying power and monthly affordability.

If you're selling:

Lower rates could bring more qualified buyers into the market, but it won't create overnight changes. What still sells homes in 2026 is what's always worked—pricing it right, marketing it effectively, and working with an agent who shows up and executes a strategy daily.

The challenge many sellers face isn't the market—it's poor execution by their agent. Homes that are positioned correctly and marketed aggressively are still selling.

The Bottom Line

Neither of these moves solves the core problem: we don't have enough homes. Policies that target demand without addressing supply create temporary shifts rather than lasting relief.

But today's rate drop is real, and it matters. Whether this holds or not depends on how the bond market continues to respond.

I'm watching this closely and will keep you updated as more details emerge. In the meantime, if you're thinking about buying or selling this year, let's talk about what makes sense for your specific situation—not based on headlines, but based on the actual market conditions we're seeing right here in Utah.

Here to serve,

| |||||||||||||||

P.S. Opportunities like this don't announce themselves with sirens—they show up quietly in rate sheets on a Friday morning. Whether you're ready to move now or planning for later this year, having a clear strategy matters more than timing the market perfectly. Reply to this email or give me a call—let's talk about your goals for 2026.