The mortgage rate roller coaster has started slowing down. According to Mortgage News Daily, the average 30-year fixed rate now sits at 6.28%—down from last year’s 7.05%. But I wouldn’t expect any major dramatic drops from here.

Table of Contents

2026 Mortgage Rates Forecast

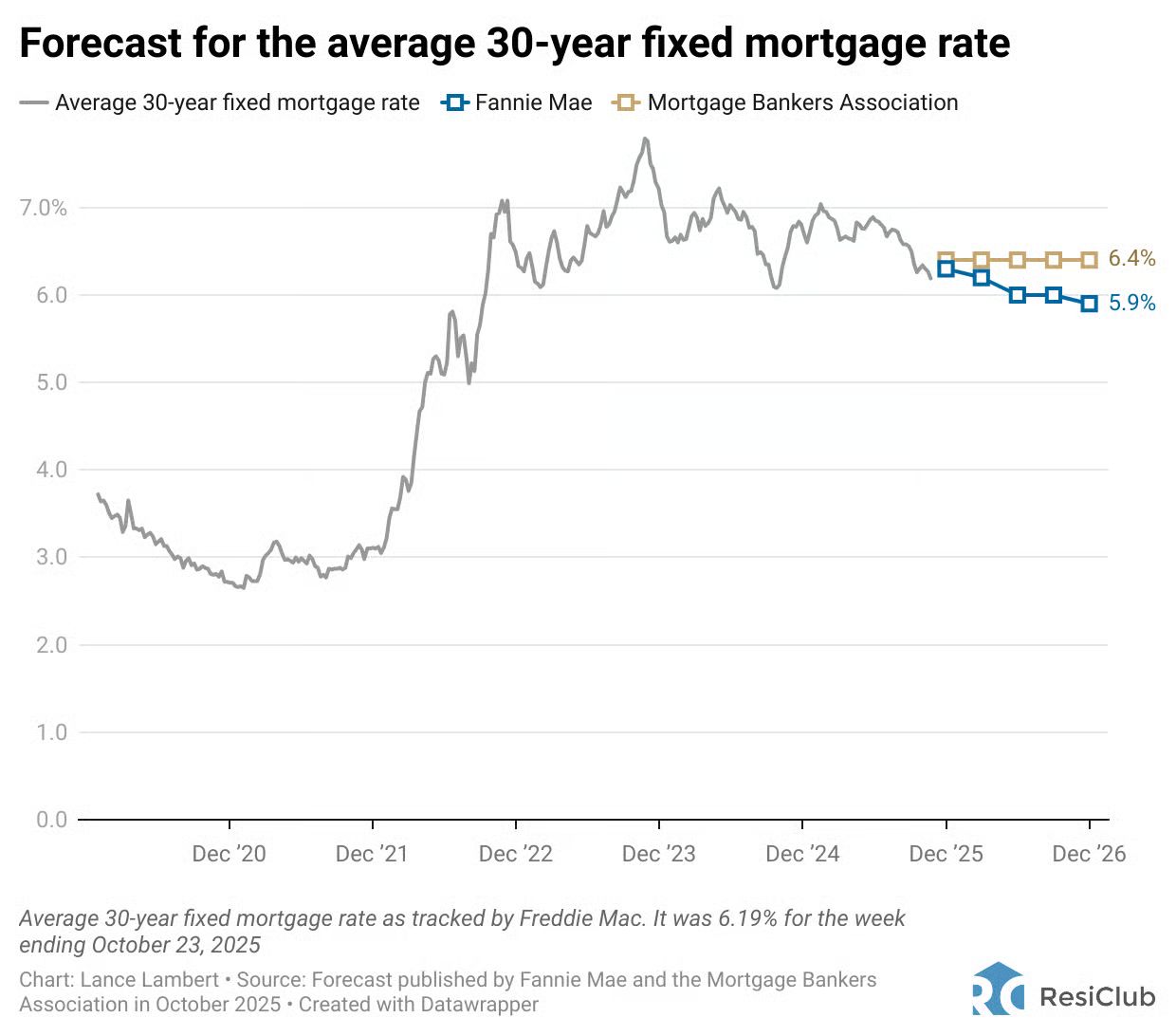

Fannie Mae, Mortgage Banker’s Association, and most economists say most rate relief has already happened. The odds of big decreases from here are slim. We will likely continue to see lower rates over the next 12 months, but they most likely won’t be the massive drops that many people have been hoping for.

In fact, Fannie Mae and Mortgage Banker’s Association expect mortgage rates to end 2026 somewhere between 5.9%-6.4%, pretty close to where we currently are.

If you’re a buyer

If you’re still waiting for mortgage rates to drop further, you might miss out on the opportunities right in front of you. Now is the time to lock in a good deal while the market is favoring buyers. Many buyers are getting sellers to pay their closing costs, buying down their mortgage rate (making your monthly payment more affordable), and sometimes even offering price reductions.

If you’re a seller

The good news for sellers is that even with a slower buyer’s market, we’re still experiencing demand for homes that are priced well and marketed properly. This is the difference between a neighbors home that’s been sitting for 6 months with no offers and the other neighbor that sold within 20 days with multiple offers.

Working with the right realtor will allow you to take advantage of this moment in time when many other sellers are still pricing their homes incorrectly and marketing poorly, giving you the chance to really stand out in today’s market.

Bottom Line

If you’ve been on the fence, don’t let the window close!

Reply to this email or give me a call to chat about your options and build a winning strategy in this market.

Here to serve,

| |||||||||||||||

P.S. Market conditions can change quickly. If you've been waiting for the "right time" to make a move, let's talk about whether that time might be now.