Housing affordability has everyone talking—from Washington, D.C. to kitchen tables across Utah. With mortgage rates still elevated and home prices near historic highs, policymakers are floating creative solutions to unlock the market. Two ideas have recently grabbed headlines: 50-year mortgages and portable mortgages.

Let's break down what these proposals actually mean and how they could impact your next move.

Heads up, this one is going to be a bit longer, so feel free to use the table of contents below if there’s a specific issue you’re interested in.

Table of Contents

The 50-Year Mortgage: Lower Payments, Higher Cost

The White House recently floated the idea of introducing 50-year mortgages as a way to make monthly payments more affordable for first-time buyers. At first glance, it sounds appealing—stretch your loan over half a century, lower your monthly payment, and boom: homeownership becomes more accessible.

But here's the reality: While a 50-year mortgage might shave about 7% off your monthly payment compared to a 30-year loan, you'd pay dramatically more in total interest—potentially double. On a $400,000 loan, you'd pay roughly $980,000 in interest over 50 years versus $483,000 on a 30-year mortgage.

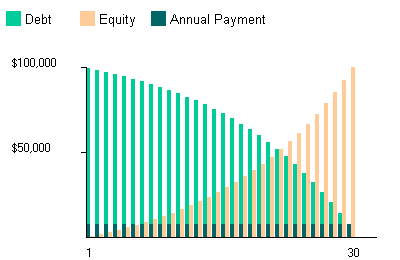

Even worse, you'll build equity at a snail's pace (in regards to paying down the principal on your mortgage). After 10 years of payments on a 50-year loan, you'd only own about 9% of your home compared to 20% with a 30-year mortgage. And lenders would likely charge higher interest rates—potentially 0.5% to 0.75% more—to compensate for the added risk of such a long-term loan.

My Take on 50-Year Mortgages

While I appreciate any effort to improve housing affordability, a 50-year mortgage isn't the solution most buyers need. It temporarily allows some first-time buyers who otherwise wouldn't qualify to enter the market—but at what cost? These buyers will build equity slower and pay substantially more over time.

More concerning: by adding more demand to an already supply-constrained market, 50-year mortgages could actually push prices higher, making affordability worse in the long run.

Portable Mortgages: The Game-Changer?

Here's where things get interesting. The other idea being discussed is portable mortgages—allowing homeowners to transfer their existing low interest rate to a new property when they move.

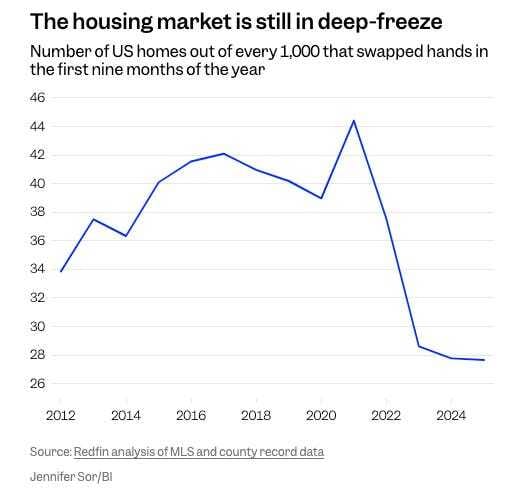

If you locked in a 3% mortgage back in 2021, you might be hesitant to move. Moving to a new home today means giving up that rate for something closer to 6.25% (unless you have a realtor like myself helping you get a much lower rate). That's why housing turnover is at a 30-year low—only 28 out of every 1,000 homes sold this year.

Portable mortgages could unlock that frozen inventory. Homeowners with great rates could finally upgrade or downsize without the financial penalty. More listings hit the market. Buyers get more options. Win-win, right?

The Challenge with Portability

Not quite. While portable mortgages exist in Canada, there's a crucial difference: Canadian mortgages typically reset every 1-5 years, so lenders aren't stuck holding low-rate loans for decades. American mortgages are often a locked, fixed rate for 30 years.

If millions of homeowners could port their 3% mortgages indefinitely, banks would be forced to hold money-losing loans on their books for generations. The solution? They'd raise rates across the board for everyone else to compensate—potentially making mortgages even more expensive for new buyers.

There are also massive legal and logistical hurdles. Most U.S. mortgages have a "Due On Sale" clause allowing the lender to request the loan to be paid off when the property sells. There’s technically a way to get around this with what’s called subject-to financing, but lenders still have the right to call the loan due if they see new ownership on title.

My Take on Portable Mortgages

Despite the challenges, this idea has real potential. Portable mortgages could free up inventory and provide relief for homeowners feeling stuck. The key concern is implementation—it would need careful structuring to avoid lender bankruptcies or making rates worse for first-time buyers.

And here's the reality: Many of those sellers will also become buyers, so the net impact on inventory might be smaller than expected. But anything to help unlock additional existing housing inventory is welcomed.

The Real Solution: Build More Homes

Here's what both of these proposals miss: The core problem is supply, not financing.

When zoning restrictions make it hard to build and construction costs stay high, prices rise no matter how creative we get with mortgages. Whether it's 50-year loans, portable rates, or any other financial engineering—none of it addresses the fundamental shortage of housing.

The long-term solution remains the same: We need to build more homes. Which means relaxing zoning restrictions, reducing impact fees, limiting red tape, and providing financial incentives for builders to build more quality housing. Until supply catches up with demand, we'll continue to face an affordability crisis no matter what mortgage products we introduce.

What This Means for You

If you're a buyer: Don't wait for 50-year mortgages to save the day. Focus on what you can control—your down payment, your credit score, and finding the right property. These policy changes, if they happen at all, won't be a silver bullet.

If you're a seller: The good news is that you’re somewhat insulated from higher or lower prices since the value of your home will likely follow the market. But understand that market conditions are slowly shifting in buyers' favor as inventory rises. If you've been holding off on listing because you don't want to lose your low rate, portable mortgages could change that calculus—but don't count on it anytime soon. In fact, I expect 2026 will most likely be more of what we saw this year with mortgage rates in the high 5% to low 6% range.

For everyone: Keep an eye on inventory levels and new construction in your area. Those are the metrics that will actually determine affordability over the next few years.

Your Next Move

The housing market is complex, but your path forward doesn't have to be. Whether you're looking to buy your first home, upgrade to something bigger, or finally make that move you've been putting off, don't let headlines drive your timeline. I’m happy to discuss your specific situation and what makes sense for you in today's market.

Ready to talk about your real estate plans? Hit reply or give me a call. I'm here to help you navigate whatever comes next.

Here to serve,

| |||||||||||||||

P.S. Market conditions can change quickly. If you've been waiting for the "right time" to make a move, let's talk about whether that time might be now—before everyone else figures it out too.