If you’ve been waiting for a chance to get a low interest rate before buying, you need to read this.

Did you know that savvy buyers are still getting rates in the low 4-5% range (or even lower)? Here are the three most powerful strategies to land a low mortgage rate right now—no waiting and hoping required. Plus, I’ll have multiple properties listed below that can be purchased today using these strategies.

Table of Contents

1) Rate buy downs

There are two main ways to “buy down” your mortgage rate, making your home much more affordable:

Permanent buy down:

You or the seller pays extra “points” at closing so your mortgage rate is lowered for the entire length of your loan.

This is more expensive than a temporary buy down, but is best for buyers who want the assurance of having a permanently lower rate than what’s available to the market at the time.

Temporary buy down (Like a “2-1” buy down):

The seller pays to lower your rate a larger amount for the first couple of years—often times 2% lower for the first year, 1% lower for the second year, then it goes to the normal fixed rate.

You could save $600–$700 per month during the first year, and about half that the second year—putting real money back in your pocket while you get settled.

If rates drop even further and you want to refinance before the temporary buy down expires, the remainder amount can be credited towards your refinance.

How Do You Get It?

Builders and motivated sellers are often willing to pay for these at closing. If you’re using a mortgage to purchase your next property, getting a rate buy down would save you dramatically more per month than cutting the price by the same amount. It’s a win-win scenario that allows you to save on your monthly payment.

Homes Available to be Purchased Today Using Rate buy downs:

Virtually any home on the market could be eligible for a rate buy down, wether it be a smaller buy down paid for by the buyer , or a larger buy down paid for by the seller. However, some of the best deals I’m seeing on buy downs are coming from builders. He’s an example of what Edge Homes is offering for their September incentives:

concessions = percentage of sales price seller is willing to pay towards additional buy downs, buyer closing costs, upgrades, or price reductions.

2) Adjustable Rate Mortgages (ARMs)

How It Works:

ARMs usually start with a lower fixed mortgage rate for the first 5, 7, or 10 years (example: a “7/6 ARM” is fixed for the first 7 years, then adjusts every 6 months to the current mortgage rates).

Right now, Utah buyers are seeing ARM rates around 5.5%, which is much lower than a typical 30-year fixed loan.

How Much Can You Save?

On a $500,000 home, you would save about $335/month for the first seven years using an ARM at current rates of around 5.5%.

That’s over $28,000 in total savings before the rate can adjust.

What’s the Catch?

After the initial fixed period, the rate can go up or down based on the market. If you plan to move, refinance, or get a raise before then, ARMs let you lock in big savings up front and refinance to a fixed rate 7 years from now.

Today’s ARMs have safeguards: you must qualify based on a higher (worst-case) rate, and rate increases after the fixed period are capped—making them much safer and less risky unlike the ARMs that caused problems in the 2008 crash.

Who Should Consider This?

If you know you’ll live in your home for less than 7–10 years, or plan to refinance, an ARM can be a great strategy for bigger savings and a more affordable Utah payment now.

Homes Available to be Purchased Today Using ARMs:

Similar to rate buy downs, virtually any home getting financing could be eligible for an ARM. When speaking with a Lender, you would ask them to compare different ARM options to fixed rate options.

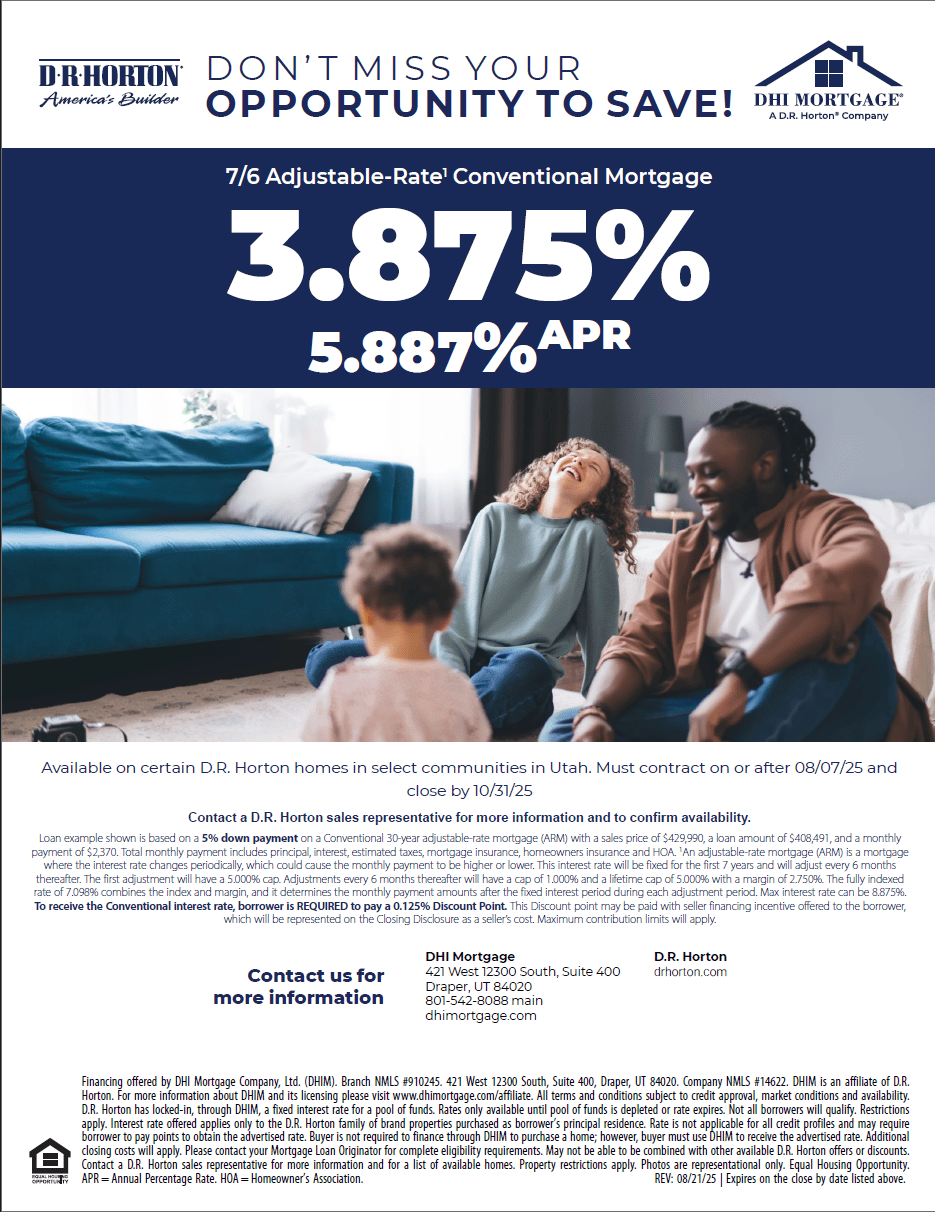

That being said, some buyers are combing strategy 1 and 2 by getting an adjustable rate mortgage, plus a mortgage rate buy down securing even lower rates. For example, DR Horton is offering 7/6 ARMs with a 3.875% mortgage rate right now on many of their new builds. That means 3.875% for the first 7 years, and adjusts every 6 months to market rates after that. Considering most homeowners move or refinance within 7 years of owning their home, you may have a mortgage rate in the 3% ranges for the entire duration of having that loan, giving you plenty of time to build equity and save.

This has to be one of my favorite strategies for buyers right now. Even if you don’t want to purchase new construction, you can use a combination of rate buy downs and a 7/6 ARM to secure a killer mortgage rate.

3) Seller Financing: No Bank Needed!

How It Works:

This option applies when a seller is willing to “be the bank.” Instead of getting a bank loan, you make your monthly payments directly to the seller.

Terms—like mortgage rate, down payment, and loan length—are totally negotiable between you and the seller.

How Much Can You Save?

It’s not uncommon for seller-financed homes to offer rates a full 1% lower than bank loans (but sometimes maybe even more).

Example: On that same $500,000 home, if a seller finances at 5.5% (vs. a 6.5% market rate), you’ll save about $335/month from day one—sometimes even more, depending on the deal.

Many seller-financing deals have lower fees, too, and sometimes skip standard bank hoops like appraisals, simplifying the process and saving money for everyone.

What’s the Catch?

Seller financing is usually offered on a limited number of homes. The seller has to be willing to take payments over time rather than receiving the full amount upfront.

The deal’s structure and protections depend on the written agreement, so it’s smart to work with an agent and a good local real estate attorney to make sure everything is clear and fair.

Who Should Consider This?

Buyers who can’t qualify for traditional loans, want maximum flexibility, or just want to save money and skip the banks.

Both buyers and sellers willing to create a win-win opportunity for everyone involved. Seller gets to make money off mortgage that the buyer would have paid to the bank, and the buyer pays less mortgage overall. This can save the buyer hundreds of thousands of dollars over the course of the loan while also making the seller an extra hundreds of thousands of dollars over the course of the loan.

Homes Available to be Purchased Today Using Seller Finance:

While your options will be more limited as fewer sellers are willing to offer seller financing, there are still plenty of deals to be made in this realm as more sellers are realizing this is a good way to provide homebuyers with relief while still selling their home for the price they need or more.

For example, one of my clients currently has their 5 bedroom, 3 bathroom home with every upgrade you could think of listed and open to negotiating seller finance options. Simply reply “seller finance” to this email if interested and I can send you more details.

Why Move Quickly?

Lenders and sellers are getting creative right now, and these options can give you a huge edge—but conditions change fast. If you want to see exactly which strategy best for you, reach out today! There are plenty of really great deals to be had in this market.

Let’s start by build your step-by-step plan for getting your perfect home with less stress.

Here to serve,

| |||||||||||||||

P.S. Market conditions can change quickly. If you've been waiting for the "right time" to make a move, let's talk about whether that time might be now.