Something interesting happened this week that could signal big changes ahead for our housing market.

Stuart Miller, co-CEO of Lennar (America's second-largest homebuilder), dropped a hint during their earnings call on Wednesday that caught everyone's attention: The federal government is actively working on something to address housing affordability, and it might arrive in 2026.

Table of Contents

What Did He Say?

Miller revealed that major homebuilders have been in discussions with the administration about housing affordability challenges. When asked if he thought something would come out of these talks in 2026, he said: "I'd be surprised if something isn't done."

Why Does This Matter?

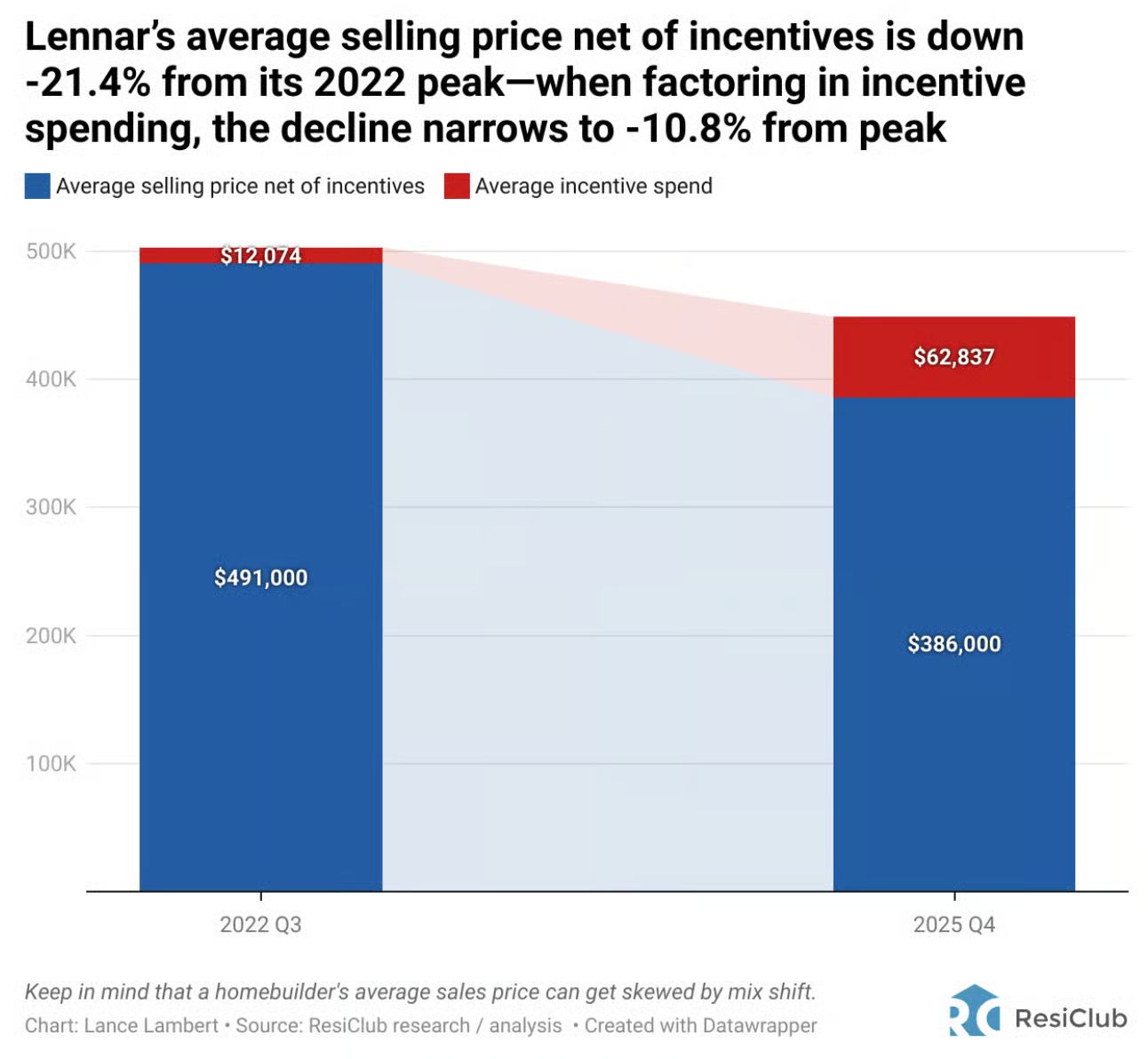

Right now, Lennar is spending an average of $62,837 in incentives on each home they sell—think mortgage rate buydowns, closing cost assistance, and price reductions. That's how much they're having to discount just to keep homes moving in today's affordability-strained market.

Miller suggested that whatever the government is considering could be significant enough to improve market conditions and reduce the need for these massive incentives.

What Could This Look Like?

The administration has floated a few trial balloons recently:

50-year mortgage options (though this faced immediate backlash)

"Portable" mortgages (details remain unclear)

Other affordability programs yet to be announced

The specifics are still murky, but the fact that serious conversations are happening is noteworthy.

What This Means for Buyers

If federal action materializes, you could see:

New financing options that lower monthly payments

Programs that make homeownership more accessible

Potential for reduced builder incentives (meaning less negotiating room, but perhaps a healthier market overall)

What This Means for Sellers

Government intervention aimed at boosting affordability typically:

Brings more buyers into the market

Increases demand, which can stabilize or lift prices

Creates a more balanced market for buyers in the short term, but leads to higher prices long-term.

What This Means for Utah

Utah has climbed back above pre-pandemic 2019 levels. That means buyers here have more options and negotiating power than they've had in years. If federal affordability measures kick in during 2026, Utah could see renewed buyer activity—particularly from first-time buyers who've been priced out.

The Bottom Line

We don't know exactly what's coming or when, but having homebuilders this confident about federal action tells us something is brewing. Whether you're thinking about buying or selling, 2026 could bring significant changes to how affordable—and how accessible—homeownership becomes.

I'll be watching this closely and will keep you updated as more details emerge.

Questions about buying or selling in this shifting market?

I specialize in helping sellers position their homes strategically—especially properties that have struggled to sell or need a fresh approach to stand out. Let's talk about your specific situation and how to navigate what's ahead.

Here to serve,

| |||||||||||||||

P.S. Market conditions can change quickly. If you've been waiting for the "right time" to make a move, let's talk about whether that time might be now—before everyone else figures it out too.